Bad Debt Relief Gst Malaysia

This relief is allowed on condition that gst has been paid and sufficient efforts have been made to recover the debt.

Bad debt relief gst malaysia. Notification on claim bad debt relief. You can apply for bad debt relief from the comptroller of gst for return of the output tax previously accounted for and paid by you. On the other hand if you as a customer have not paid your supplier within 12 months from the due date of payment you are required to repay to the comptroller the input tax that you have.

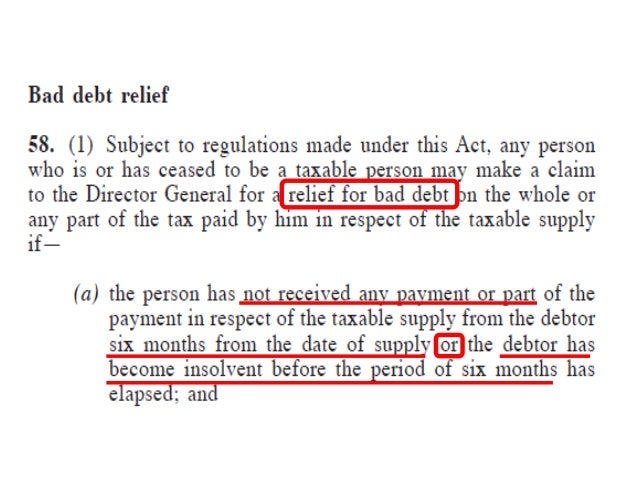

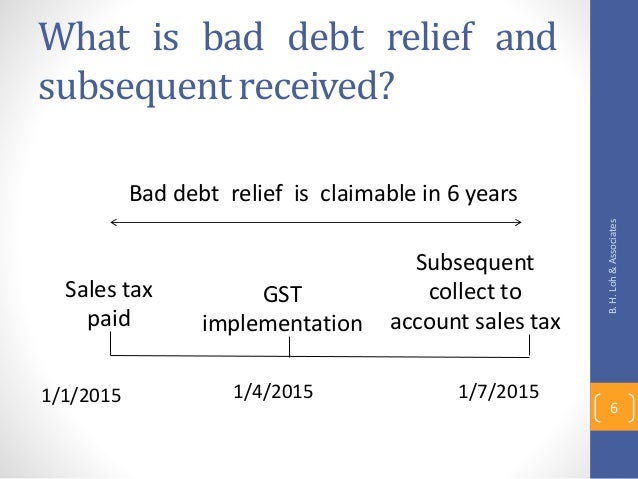

Bad debt relief recovery bad debt relief. In accordance with section 58 of the goods and services tax act 2014 with effect from 20 6 2016 if the bad debt relief is not claimed by the supplier in the immediate taxable period immediately after the expiry of the sixth month the notification to the director general to defer such claims must be made through tap. 1 s ubject to regulations made under this act any person who is or has ceased to be a taxable person may make a claim to the director general for a relief for bad debt on the whole or.

Gst malaysia gst bill to be gst act. After login to gst bad debt relief user needs to key in the month of six and gl posting date the click the generate button. Note that it is six calendar months and not 6 months from date of invoice.

Any part of the tax paid by him in respect of the taxable supply if. Bad debt relief peter tan. Make sure that the outstanding shown in gst bad debt relief is the same with the customer aging report detail.

For the purposes of gst in malaysia bad debt relief refers to any amount owing on an invoice that has not been paid or has been partially paid after six calendar months from the date of issue. A bad debt situation occurs when money that is owed cannot be recovered. Bad debt relief recovery.

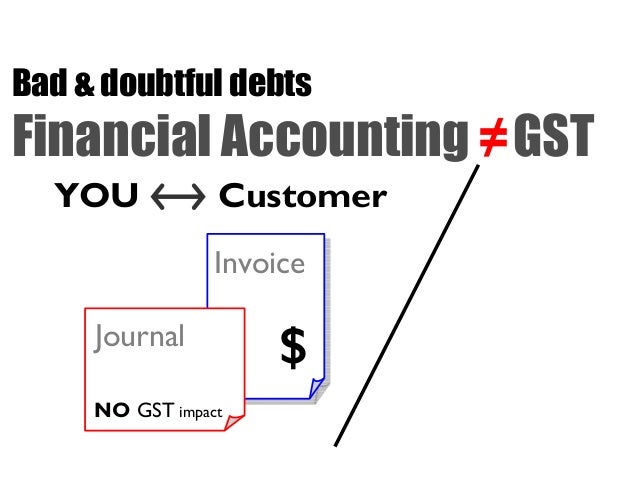

Item 6 what is the gst treatment for goods manufactured locally which is supplied or sold by a local supplier to an overseas buyer but the goods are in the possession of the supplier and subsequently released for export in stages as instructed by the overseas buyer. Dr bad debt 2000 00 dr input tax 120 00 cr debtor 2120 00 if the customer pay you after you have claimed the bad debt relief from the kastam you to do the following accounting entry dr bank 2120 00 cr bad debt recovered 2000 00 cr output tax 120 00 conclusion. Record keeping records must be kept in the principal place of business for at least 7 years either in soft or hard copy and they must be either in bahasa malaysia or english.

Bad debt relief 15.