Bank Draft Vs Cheque Canada

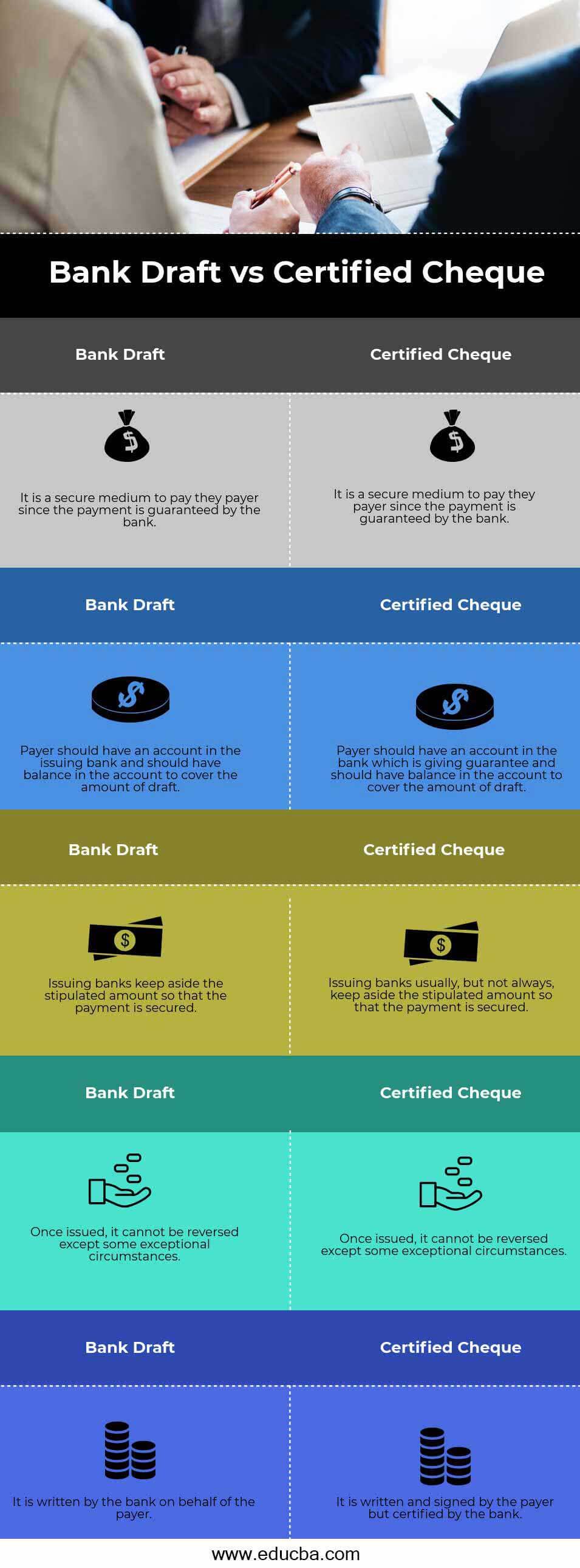

Key differences between bank draft vs certified cheque.

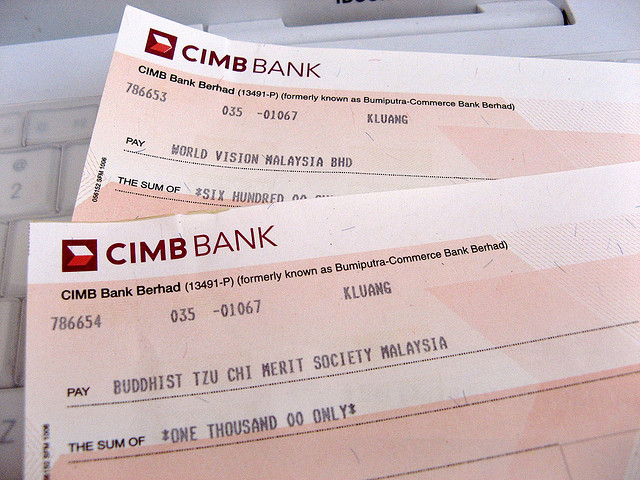

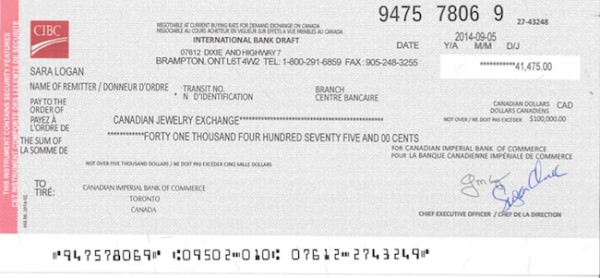

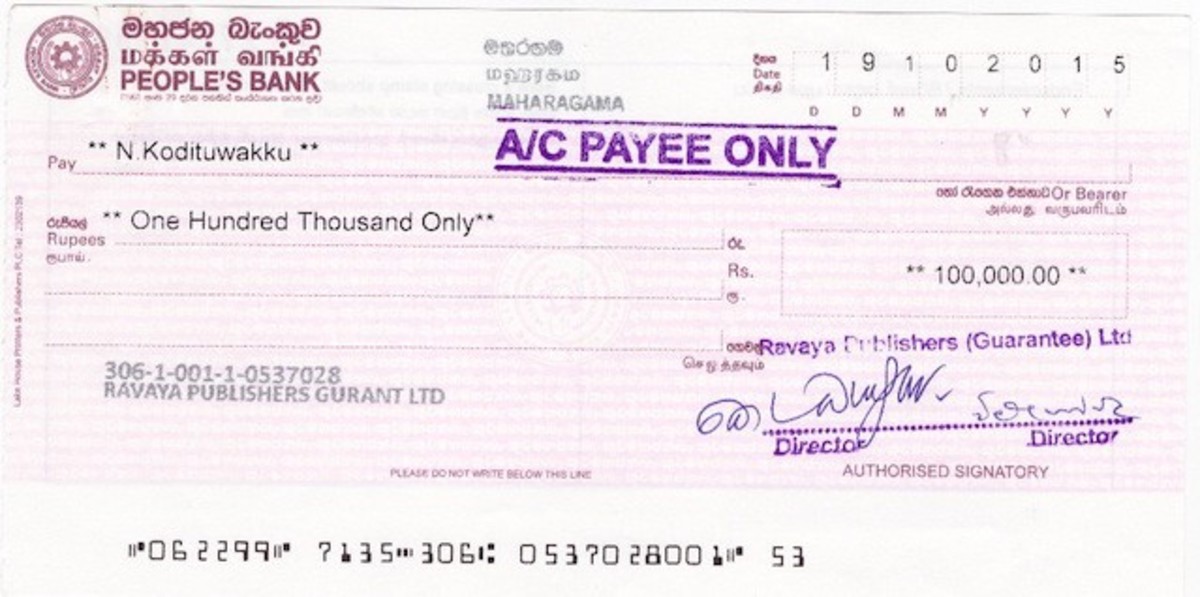

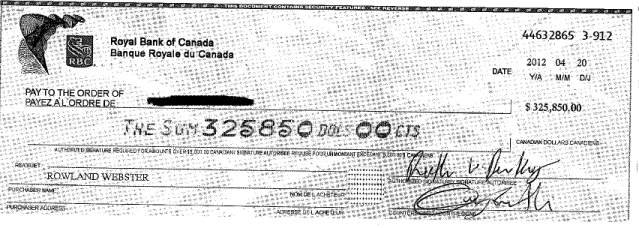

Bank draft vs cheque canada. A banker s draft also called a bank cheque bank draft in canada or in the us a teller s check is a cheque or check provided to a customer of a bank or acquired from a bank for remittance purposes that is drawn by the bank and drawn on another bank or payable through or at a bank. Bank draft is a financial instrument issued by bank in favor of a specified entity on the request of the payer where payment is already received by the bank and the amount is transferred to that entity when it is presented whereas a certified cheque is issued by someone who has an account with the bank in favor of payee where the amount is. Bank drafts are guaranteed by a bank and have the same liquidity as cash in general.

Bank drafts are essentially cheques on a bank s account in another bank says david weiman a professor of economics specializing in banking at barnard college an affiliate of columbia university. Cheque vs bank draft. Read our five risk management tips below to reduce the risk of a hold on trust cheques certified cheques and bank drafts.

A bank draft unlike a cheque does not require a signature however a certified bank draft is signed by a bank official making it more secure and fraud proof. Bank drafts are similar to cashier s checks in that they are considered safer than a personal check at least from the perspective of the person receiving the funds in question. Let us discuss some of the major differences between bank draft vs certified cheque.

The cost of a bank. Ask questions to obtain information about the client and the source of funds. At that time the bank reduces your available balance by the amount of the draft and designates it as a pending transaction.

More specifically bank drafts and certified cheques are both payment mechanisms that are made available to bank customers. Bank drafts usually cost between 4 and 6 cad depending on the bank. Canadian banks issue bank drafts for amounts greater than 1 000 cad.

Furthermore since a bank draft is guaranteed by the bank individuals making large payments prefer the use of a bank draft instead of a cheque. The financial institution issues a bank draft upon your request but only after verifying that your account has sufficient funds to cover the check. The bank draft sometimes called a certified bank draft is drawn on funds that are on deposit with that bank and payment is guaranteed by that issuing bank.

As discussed earlier both bank draft vs certified cheque is used to transfer funds to the payee when the amount in bigger both the parties only have a professional relationship and safety of the funds is a priority for both of them. Difference between bank draft and certified cheque. Omply with the law society s client identification and verification rules.

Bank draft vs certified cheque bank draft and certified cheque are among the different services banks offer to their customers as such it is beneficial to know the difference between bank draft and certified cheque.