What Is Form 941 And 940

The main difference between the two forms is that form 940 doesn t apply to companies who don t have employees working for them.

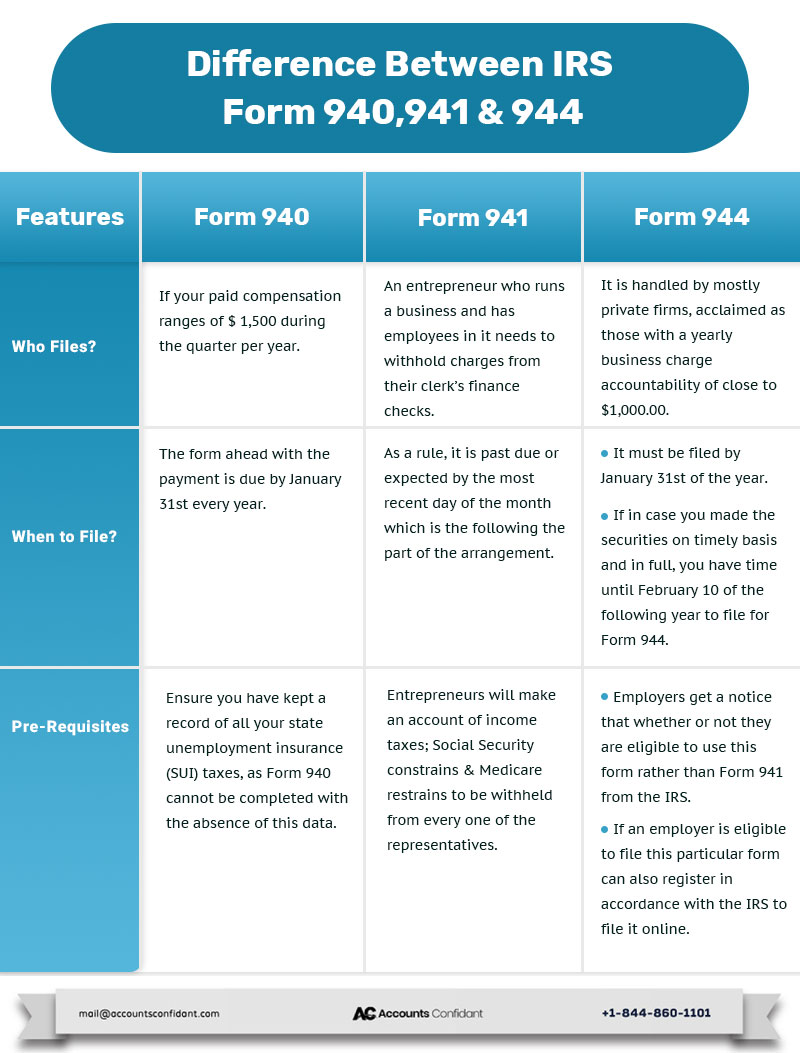

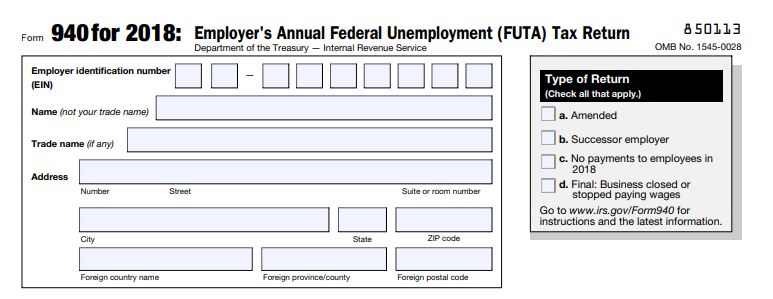

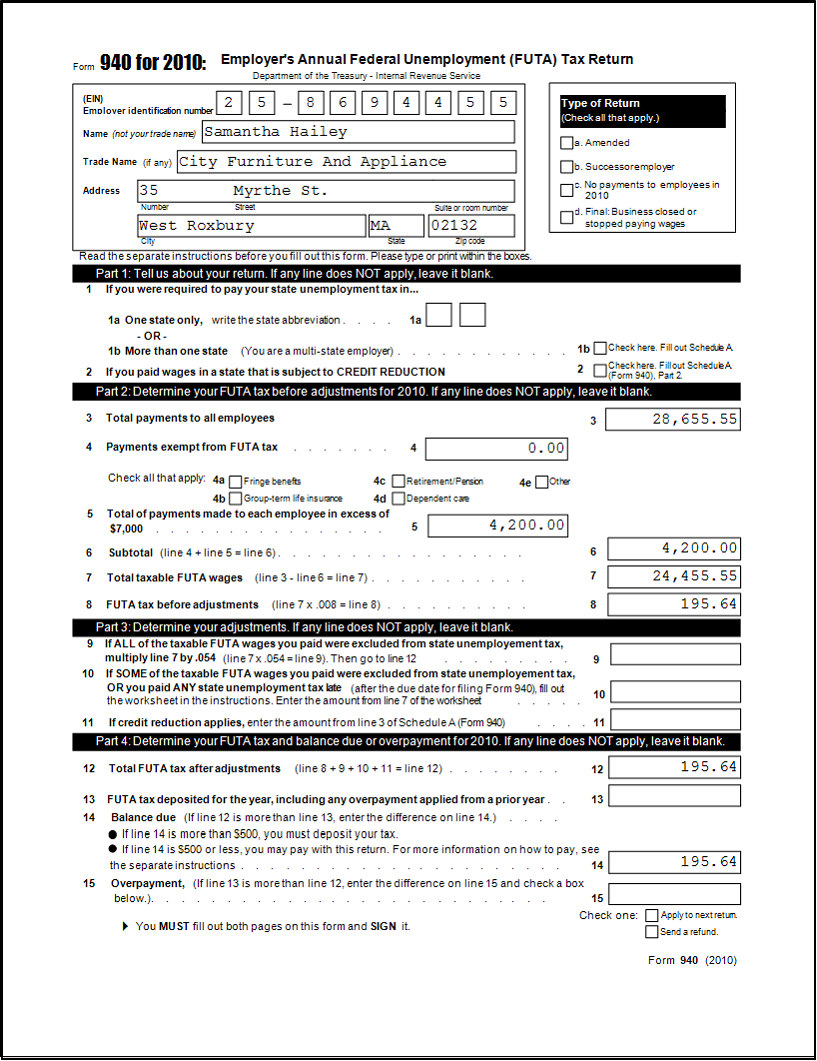

What is form 941 and 940. Irs form 940 is the federal unemployment tax annual report. This article will talk about some specific tax forms like irs form 940 form 941 and form 944 and their planning preparation guidelines and filing. This is the employer s annual federal unemployment futa tax return.

Employees don t have to pay for it. Irs form 940 is an annual form that needs to be filed by any business that has employees. Futa tax is stringently an employer paid tax.

You can complete the irs e file application online after registering for e services. What are irs forms 940 and 941. Employers must report and pay unemployment taxes to the irs for their employees.

This form reports the business s federal unemployment taxes pursuant to the federal unemployment tax act futa. Filers notified by the irs to file form 944 more below do not file form 941. The key difference here is that form 941 is how you report withholding and shared taxes those that are split 50 50 between the employee and employer.

When is it due. So the key difference between form 940 and 941 is that form 940 reports futa tax which is paid entirely by the employer whereas form 941 reports withholding and shared taxes that are split between the employee and employer. The form 942 is the.

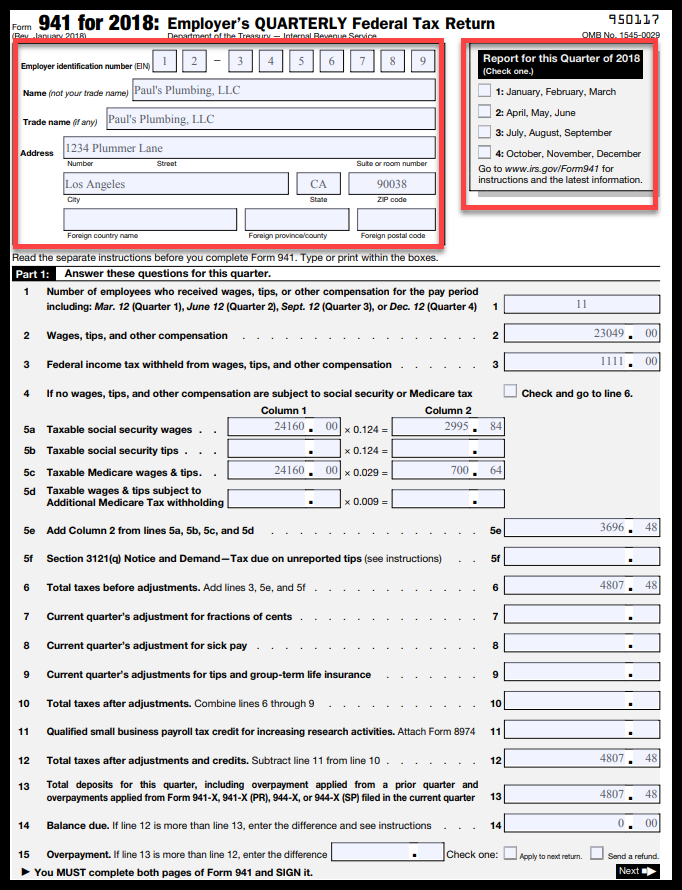

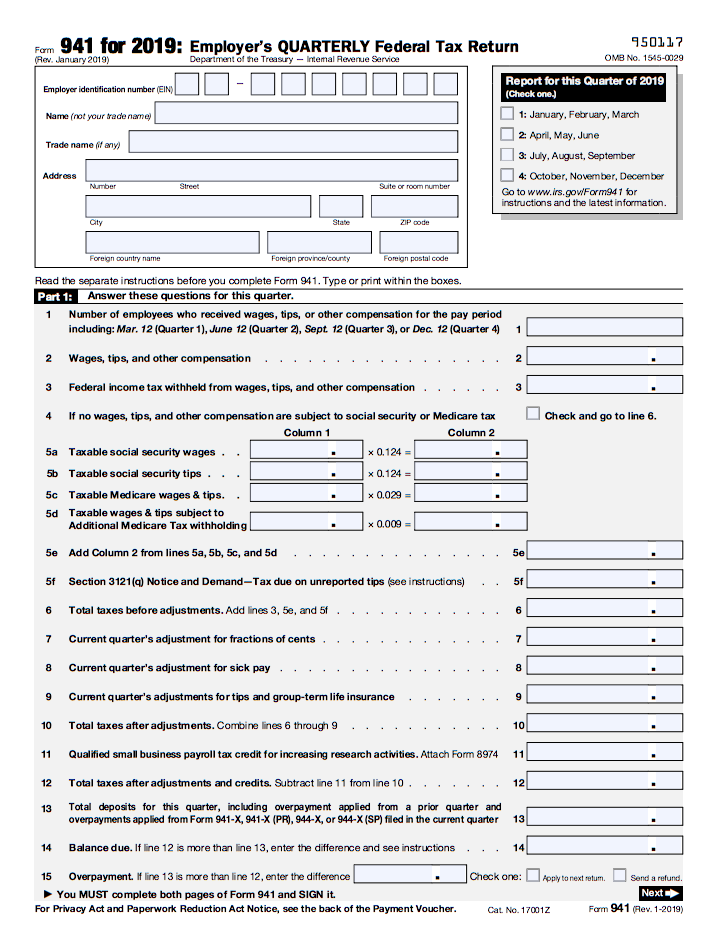

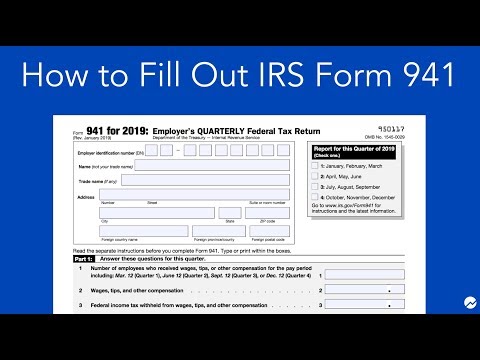

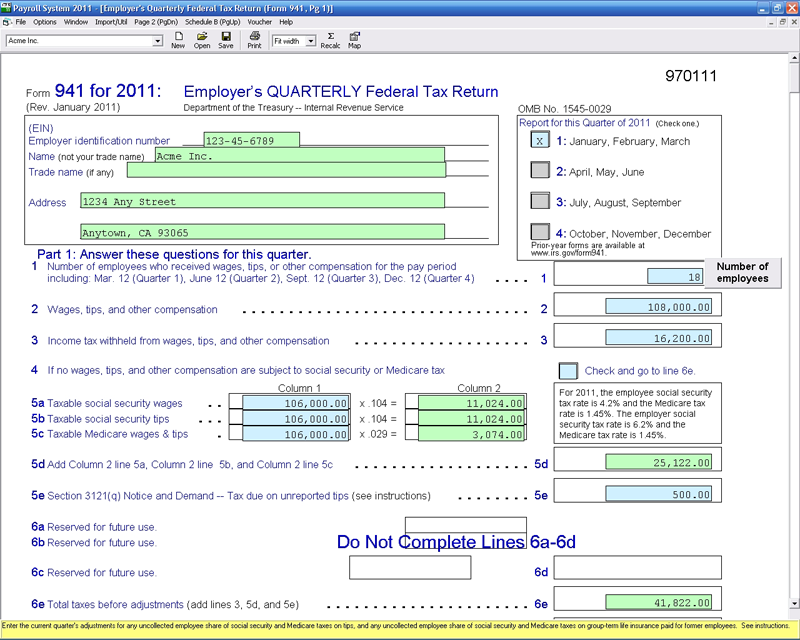

If you have a sole proprietor business that has employees you may pay your household employment taxes with your business or farm employment taxes and you must include your household employment taxes with those other employment taxes on form 941 employer s quarterly federal tax return form 944 employer s annual federal tax return or form 943 employer s annual federal tax return for. The modernized e file mef for employment taxes and e file employment tax forms pages offer ways to file forms 940 941 and 944 electronically. Form 941 employment tax is an employer s federal tax return that has to be paid quarterly applies to employers who withhold or interfere in some other way with the income taxes medicare s taxes and or social security taxes of the employees can be done by making changes to the pay checks by which the employees are paid also applies to the employers who must pay part of the social security or medicare tax and hence use the form 941 in order to report these taxes.

They don t deduct these employment taxes from employee pay but they must set aside the appropriate amount and report it on form 940. Form 941 is due each quarter by the last day of the month following the quarter end april 30 july 31 october 31 and january 31. Irs form 941 reports federal income tax withholding and federal insurance fica taxes and it is filed every quarter.

Employers don t need to file for seasonal employees except in the quarter they worked. The business is responsible for the tax and does not come from employee wages. These business owners are still responsible for paying state unemployment tax though.

/how-and-when-to-file-form-941-for-payroll-taxes-398365_FINAL-3e897153189040e99df9b89437493b7b.png)